AI Financial Adviser(Ongoing)

Year : 2024

Media : UX & UI design

BACKGROUND

Inspiration:

I draw inspiration from the pervasive financial challenges faced by many in the U.S. While some seek financial advisors, a significant portion does not, prompting an exploration into their pain points. One crucial insight is the aversion to being sold to, rather than being taught—a disconnect between traditional sales-driven approaches and the genuine need for education. Additionally, the urgency of living paycheck to paycheck often eclipses the long-term benefits of seeking professional guidance. Through user-center design, my aim to bridge this gap by prioritizing user needs and creating solutions that resonate with real-life experiences. my focus is not just on financial strategies, but on understanding the human stories behind each financial struggle. By shifting the paradigm from sales to education and addressing immediate needs while fostering long-term financial health, we aspire to empower individuals to take control of their financial futures with confidence and clarity.

RESEARCH

Research Goal & Plan

Identify the target audience for the product by understanding which users would benefit most from its features and functionalities.

Explore and document the pain points experienced by potential users in relation to financial management, including their knowledge gaps, sources of information, and levels of experience.

Investigate users' existing knowledge about money management to gauge their understanding of financial concepts, strategies, and tools.

Determine where users typically seek information and resources related to money management, such as online platforms, financial institutions, or personal networks.

Assess users' experience levels with financial management tools and technologies to tailor the product's user interface and features effectively.

Methodology

User Base

Queenie, 26, female, MFA, Chicago, NG who is looking for a job

Dave, 45, male, lake bluff, Home Depot manager

Alex Rodriguez, 32, male, Chicago, user researcher at a fintech company

Sisi Chen, 25, female, Bachelor in management, China, financial advisor in GuangFa Bank

Peter, 31, male, Chicago and Hungary, Data analyst in a financial factory

Interview & Contextual Inquiry

CONCEPT

Affinity Map

Personas

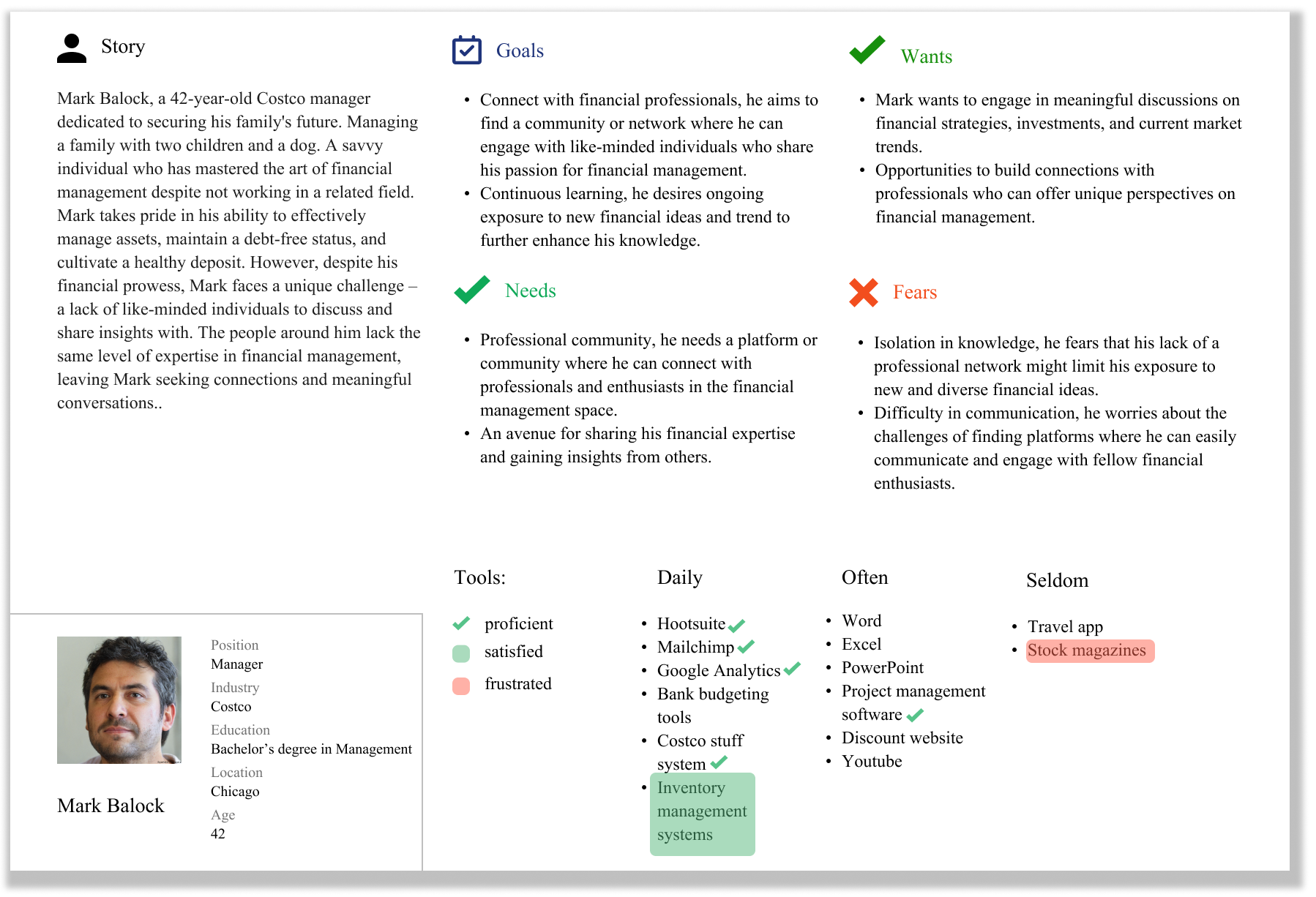

Three personas embodying varying levels of financial literacy and experience:

Novice Navigator lacks prior knowledge but is thrust into budgeting due to life's demands.

Learning Adventurer possesses basic understanding but seeks to expand knowledge and streamline financial management.

Master Strategist is an expert in financial planning, wielding extensive knowledge and strategic finesse.

User Journey Map

DESIGN

Design goal & scenario

Goal 1: budgeting

Scenario 1: Unexpected expenses

A receives an unexpected medical bill that A didn’t budget for and needs to quickly adjust budget to accommodate this unforeseen expense.

Scenario 2: Multiple income sources

B has multiple income sources with varying frequencies and needs a budgeting tool that can accommodate irregular income streams.

Scenario 3: Goal-based budgeting

C wants to save for a specific financial goal, such as a vacation or a down payment on a house. C needs a budgeting tool that helps him allocate funds towards these goals.

Scenario 4: Collaborative budgeting

A couple or some roommates share financial responsibilities and want a budgeting tool that allows them to collaborate on managing their shared expenses and individual spending.

Scenario 5: Irregular expenses/periodic expenses

D occasionally incurs irregular spending like home repairs or vehicle maintenance. D needs a budgeting tool that helps D plan for and manage these unpredictable costs.

Scenario 6: Debt repayment

E has student loans and wants to efficiently manage debt repayment alongside a regular budget, E needs assists in tracking and optimizing debt payments.

Scenario 7: Multiple currency handling

F frequently travels for work and manages finances in multiple ways that needs a budgeting tool that accommodates different currencies seamlessly.

Goal 2: make a plan, guidance

Scenario 1: Creating a personalized financial plan, income and expense forecasting, automated savings plan

A wants to create a financial plan to save for A’s future goals. A needs guidance on setting achievable goals and managing income effectively.

Scenario 2: Financial health checkup

A couple want to assess their overall financial health and identify areas for improvement. They need guidance on optimizing their budget and increasing their financial well-being.

Scenario 3: Retirement planning

B wants to create a solid retirement plan, and guidance on how much to save, where to invest, and when to retire.

Scenario 4: Debt repayment strategy

C wants to efficiently repay debt and create a strategy to become debt-free. C needs guidance on how to structure a debt repayment plan.

Scenario 5: Investment diversification

D wants to diversify investment portfolio to minimize risk.

Scenario 6: Financial coaching sessions/Financial education hub

E is looking for ongoing guidance and support in managing E’s finances. E wishes to have access to financial coaching sessions without the high costs associated with traditional financial advisors.

Scenario 7: Financial checklists for life events

F is going through major life events like getting married, buying a house, and starting a family. F needs a tool that provides checklists and guidance for managing finances during these significant life changes.

Goal 3: education/social network/knowledge sharing

Scenario 1: Financial education community

A is very good at managing finances and A is eager to learn more about personal finance and wants to connect with others who share similar interests. A is looking for a platform that combines financial education with a community experience.

Scenario 2: Financial challenges and solutions

B is facing a specific financial challenge and is seeking advice from people who have overcome similar situations.

Scenario 3: Financial planning workshops/webinars/expert panels

C is interested in attending financial planning workshops to enhance his knowledge, which offers virtual workshops and connects C with like-minded individuals.

Workflow

Information Architecture

Sitemap